Invest in Yourself takes a step in the right direction

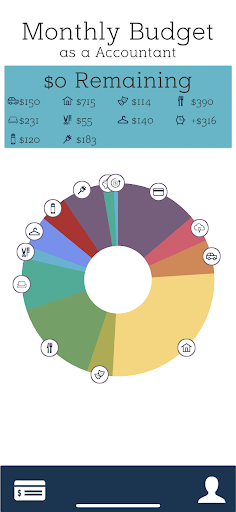

This is a screenshot from the app, “Bite of Reality 2.” This is a chart that shows where your monthly paycheck has been allocated for the month. I felt that some things I would never buy unnecessarily drained my income and therefore, made the simulation a bit less realistic for me.

For anyone who may have said, “I wish school taught us how to do taxes,” or “School has never taught us anything helpful for the real world,” the Bite of Reality fair takes a good step in addressing those concerns.

The Bite of Reality fair on April 5 was an event exclusive to seniors which went over the basics of financial responsibility and simulated the experience of having a job. In this event, seniors picked a job of their choice, ranging from accountant to zoologist.There were eleven physical stands in the auditorium where students would make financial decisions based on their lifestyle. It was endorsed by the personal finance teachers and was essentially a mini summary of lessons taught in the class.

Most stands were meant to represent a need that a senior had, for example, food, clothes, transportation, shelter and many more. There was a credit union stand, which was where seniors were to go if they encountered roadblocks such as having to make monthly payments on their purchases via an app, and an area that allows us to apply for part time jobs if our salary was too meager to cover our necessities.

Personally, I felt that the personal finance class prepared me well for this event because I learned about a lot of what was present in the fair. One thing I really enjoyed was that we could take our salary before we started, and put some of it into savings. In personal finance, saving is heavily emphasized because it is mandatory if you want to retire. It made the fair much easier for me to understand. That said, there were some flaws with the activity that made it less realistic.

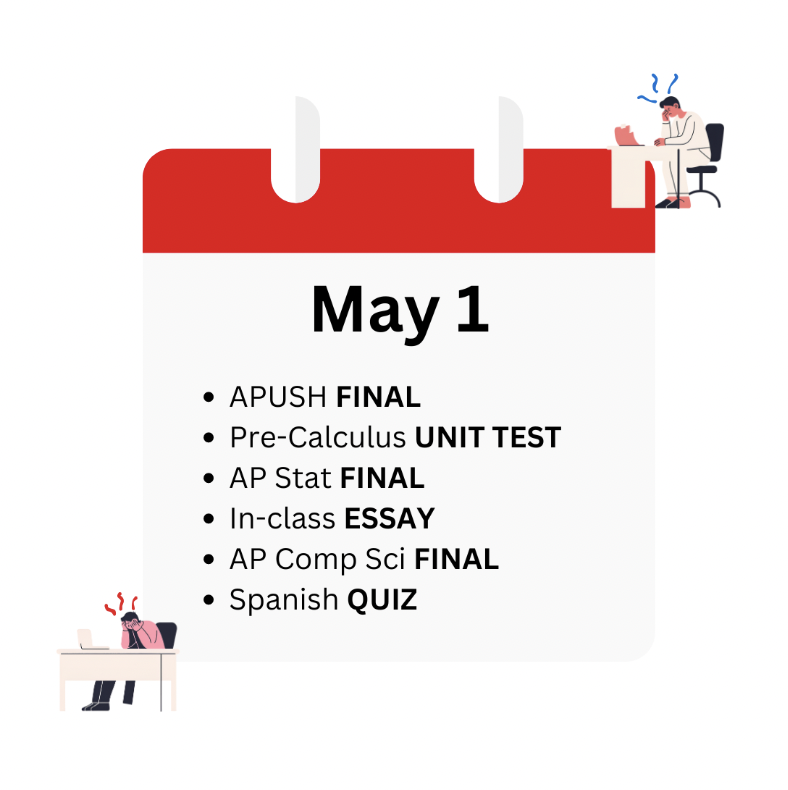

There were some purchases that were mandatory for the simulation, but not necessarily for real life. We had to pay for haircut plans, nightlife options, decorative furniture and travel plans. I felt that many of these stations didn’t apply to me because not everyone gets a haircut every month, so having to make unneeded monthly payments made me feel this wasn’t an accurate representation. Also, nightlife seemed pretty unnecessary too, since everyone I talked to ended up having to get a part time job. We were working many hours a day and it didn’t make sense to me that we would have time for nightlife. Nightlife drained a good portion of my salary. The furniture was also ridiculous, since not everyone needs to buy a $300 sofa, and that fact we were forced to buy one felt very unrealistic.

The Bite of Reality fair was a step in the right direction of what schools should be preparing students for, however, it is only that; a step. — Matthew Saw ’23

The prices for many of our necessities were all over the place as well. A bed cost $80 and a sofa would be $300.

Another problem I found to be unignorable was the app itself. The app was very buggy, constantly closing me out with every purchase I made. It sent me back to the starting screen, in which a code had to be entered every time. If that weren’t already annoying enough, the code was only given to us once in the auditorium, so I had to ask volunteers repeatedly for a new code. The app would freeze at times and was a bit difficult to navigate. This caused the credit union area to become very busy since that’s where all the volunteers were.

At the end, we were to meet with a financial advisor to analyze our decisions. I felt it was somewhat helpful, but in my mind I knew my purchases weren’t an accurate reflection of what I would actually do since some were mandatory.

I could tell a lot of effort went into making this work, but there were flaws present during it and I felt that it didn’t accurately reflect my real decisions. It was a fun event, but I feel that personal finance prepared me way more than this fair did, and many of my friends have already forgotten what they learned during the fair. If the school wanted to help us with financial decision making, personal finance should have a heavier emphasis since that class has helped me a lot more than this fair.

Web Arts Editor Matthew Saw’s ’23 interest in journalism was initially sparked in the classroom.

“Originally I was just into journalism because...