What most students don’t realize, however, is that $5 spent each day on caffeine adds up. If she continues to buy a coffee each day throughout the school year, Sigel will have spent $910 alone on Dunkin Donuts in one year.

“The little expenses that you think aren’t a big deal can add up to a lot over time and that’s where a lot of people end up wasting their money,” said Sarah White, Personal Finance teacher.

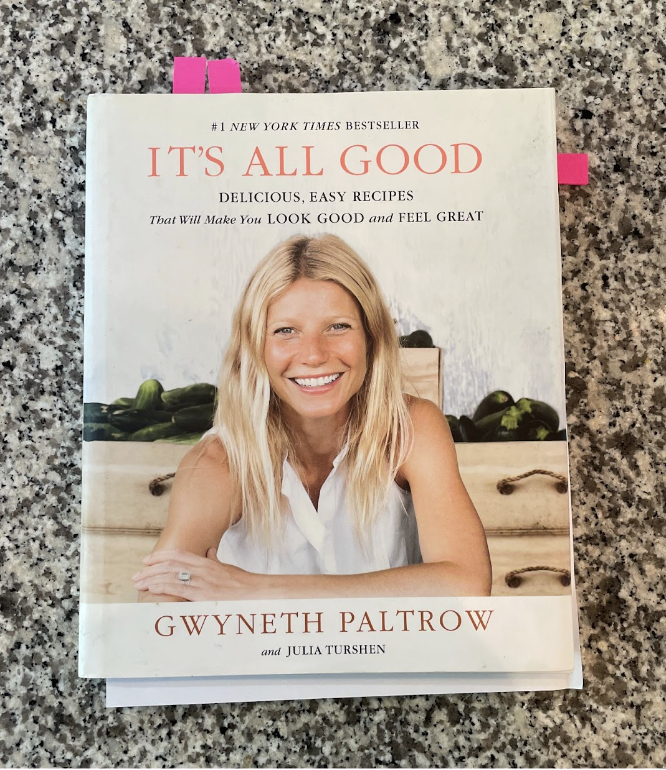

This type of scenario is known as the “Latte Factor,” coined by author David Bach, and a lot of students find themselves drowning in it. According to Bach, the “Latte Factor” is the simple idea that cutting out small unnecessary expenses such as coffee or bottled water will save people a lot of money and allow them to accumulate wealth.

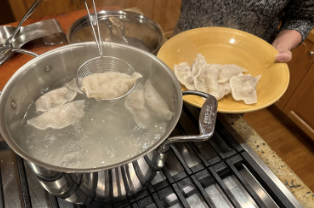

It’s certain that not all expenses can be cut down; however, students are capable of identifying the difference between their own wants and needs, said White. While It is necessary for a student to have gas so they can drive their car, White pointed out that someone could easily make coffee at home every morning–spending an average 10 cents a cup instead of $5 at Starbucks or Dunkin’ Donuts.

The word budgeting it very formal and to most students it’s something that is associated with the responsibility of being an adult.

As soon as the word budget comes into conversation, students are either confused or just drown out everything said following it.

But, they should be listening.

Lenny Klein, Personal Finance teacher, explained that budgeting all begins with wanting to save.

“I don’t know whether a lot of young adults have that desire because if you don’t want to save, you won’t,” said Klein.

Klein believes that it is important to first understand where a student’s income is coming from–whether that’s babysitting, a job with a business, or an allowance and next evaluate what a student spends their money on.

Zoe Greenblatt ’12 babysits everyday for three hours during the week making $160 each week. Rather then saving this money however, Greenblatt finds herself spending her entire paycheck on food and clothes.

“I wish that I could save my money, but I don’t have the self-control,” said Greenblatt.

White agrees that there’s definitely a temptation. “As soon as you have cash in your wallet, it’s so easy to spend,” said White.

Klein knows that it’s tough for anyone to just say “Oh yeah, I’m going to save” without understanding why you’re actually doing it.

A major reason that students should start saving is for college expenses, not the actual tuition, but money to pay for expenses said Klein.

“A lot of students don’t realize that they will probably spend a lot more money when they are living on their own rather than when they’re living at home with their parents,” said Klein.

Cooper Davis ’12 similar to Greenblatt babysits and is making around 100 to 150 dollars each week. Davis has a system where he will save half and deposit it into the bank and then keep half in his wallet to spend.

Despite the fact that every student has different responsibilities when it comes to paying for certain things, there is one common thing everyone can do, put some money away said White.

If students are concerned where to put there money and how to save it somewhere other then in a shoe box, there are a number of options. White explained that many students make the mistake of setting up an account at their parents’ bank. Instead, students should research more than one bank in Westport in order to figure out which ones have no minimum balances or fees for students.

There are also different types of accounts. For instance, if a student doesn’t want to be able to take money out, there’s an account called a CD where without a fee a person cannot withdraw money from it.

“The benefit is that it’s locked up and you can’t touch it and the downside is that it’s locked up and you can’t touch it,” said White.

For students who are confused with how much they need to put in the bank and how much to keep for everyday spending, White suggests spending one week writing down every penny spent and every penny earned in order to give students an idea of where their money is going.

“So many people get their babysitting money, and four days later they don’t know what they did with the $50,” said White.

White continued that it is important to ask “Is this something I need to spend my money on or is this just something I want?”

White provided an example –when it comes to clothing there are a lot of choices, there’s the $100 shirt and the $20 shirt. However, when it comes to gas, cheap gas is only so much cheaper than the expensive gas. A big part about saving money is making choices White said.

“It all starts with having a plan,” said Klein.