By: Alexander Massoud ’20

A potential tax on teacher salaries that would affect public school teachers is being proposed to the Connecticut state legislature.

The tax was part of the Republican state budget proposal, which was approved about a month ago, but is still being passed around the state legislature due to a Governor Malloy veto.

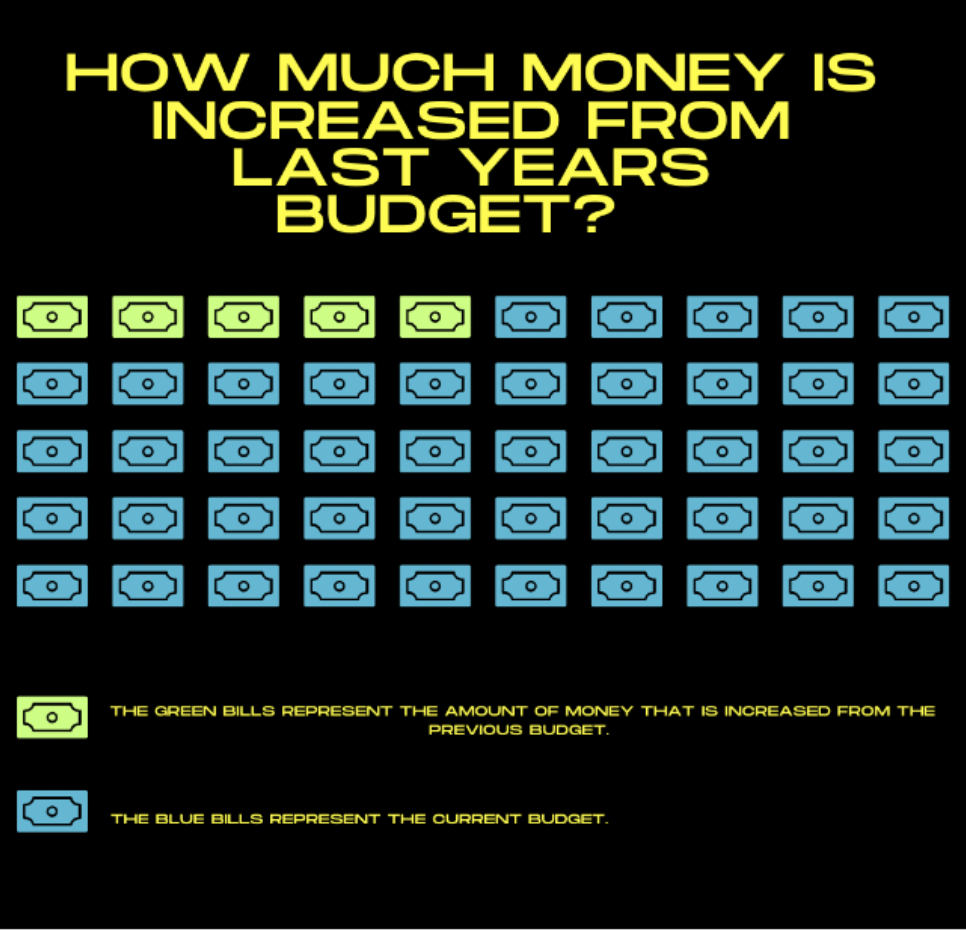

With the new budget, teachers would contribute two percent of their salaries over the next two years to the general state fund. Previously, that two percent would have gone into the state pension fund. This change would come out to about an annual loss of about $1500, which is on top of the six percent that teachers already contribute to their pension fund.

Staples radio teacher Geno Heiter is not in favor of the proposed tax. “It seems that the teachers are carrying a burden due to the mismanagement of the state legislature,” Heiter said.

Connecticut state budgets are recommended by both Republicans and Democrats, and money needs to be taken out of somewhere, as the Connecticut state government attempts to help the state recover from their $25 billion pension debt, as well as their two billion dollar state deficit, all while attempting to save Hartford from having to declare bankruptcy.

Hartford mayor, Luke Bronin, recently sent a letter to Malloy stating that if a new budget was not in place in 60 days, that “the city of Hartford will be unable to meet its financial obligations.”

This proposed legislation has been called “secret teacher tax” by Democratic senators and house members, as well as public school teachers, due to the fact that the wording in the Republican state budget is considered by some to be murky..

The Norwalk Federation of Teachers President Mary Yordon shared her thoughts on the wording of the bill, saying that “It singles out teachers, without the courage to lay it on the line and identify it, but just quietly hiding.”

The Connecticut Education Association, which is the largest teacher union in Connecticut, expressed their concern with the tax.

Furthermore, many high-ranking state officials, including the governor, believe that the teacher tax could be considered illegal, as a pension tax on teachers is not legally allowed to go into the state general fund.

“I think that’s illegal and would violate the trust requirement under law and probably would put the whole teacher pension fund in jeopardy,” Malloy said.

However, Republicans argue that this proposed bill is well within the confines of the law.

The nationwide average of the percentage of a teacher’s salary that goes into the pension fund is eight percent, but Connecticut stands at six percent, so public school teachers are already contributing less than most states to their pensions.

Governor Malloy vetoed the budget on Oct. 3, but the state House of Representatives can vote to override in the coming weeks.