It’s time for big tech’s big breakup

In the recent weeks, the library posed a question to the student body, “Why should we break up Facebook, Google, Amazon and Apple? Or shouldn’t we?” This is my response to the question. The question and my response were inspired by Scott Galloway’s book, “The Four.”

In the last two decades, the world has been radically transformed into a new, technological society that most would not have imagined just a few years prior. This revolution has allowed the world to connect between friends easier and faster than ever before, purchase a product and have it delivered to the consumer’s front door within a couple days, have our deepest thoughts, worries or questions answered in nearly 0.75 seconds (along with about 44.8 million results) with plenty more to come in the future.

Without a doubt, these technological advances have made everyone’s lives easier and more efficient. It’s made anyone or anything in the world accessible with only a few clicks or even via voice (Alexa, Siri, Google Assistant, etc). The companies that are mainly responsible for these innovations– like Amazon, Apple, Facebook and Google– need to be broken up for their monopolistic powers. Before I get into their capabilities, let’s discuss these companies’ worth.

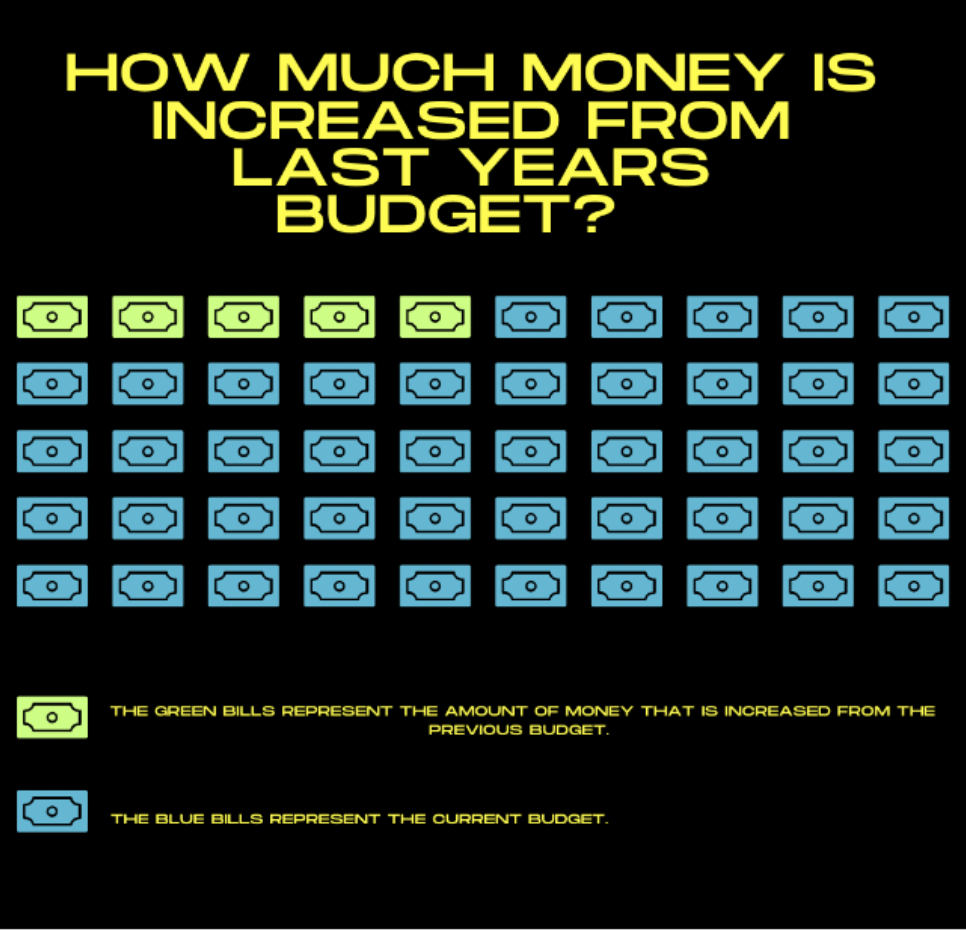

Combined, these four companies have reached the market capitalization of over $2.8 trillion, which is equivalent to the GDP of France. It’s worth mentioning that France has the seventh largest GDP in the world.

The market caps of Walmart, Costco, T. J. Maxx, Target, Ross, Best Buy, Ulta, Kohl’s, Nordstrom, Macy’s, Bed Bath & Beyond, Saks/Lord & Taylor, Dillard’s, JCPenney, and Sears combined is worth less than Amazon’s market cap of $784.16 billion.

Google and Facebook combined are worth about $1.3 trillion. To equal only 90 percent of what both companies are valued at, you could merge the world’s top five advertising agencies (WPP, Omnicom, Publicis, IPG, and Dentsu) with five major media companies (Disney, Time Warner, 21st Century Fox, CBS, and Viacom) and still need to add five major communications companies (AT&T, Verizon, Comcast, Charter, and Dish).

Apple is worth the most out of any another public company in the world with a market cap of $900 billion. Additionally, Apple’s profit margins are about 32 percent, which is similar to luxury brands like Hermès (35 percent) and Ferrari (29 percent).

If the market caps of these companies don’t scare you, then maybe the fact that Amazon, Apple, Facebook and Google are all job destroyers and major tax evaders will.

In terms of job destruction, Apple, Facebook and Google employ about 134,000 people, while WPP has over 200,000 employees. With fewer employees, these companies are making more in revenue. On the other hand, Amazon employs about 566,000 people, and it will be Amazon’s mission in the next few years to bring automation into the fulfillment centers. This means many of the jobs held in the fulfillment centers will be eliminated within years.

From 2007 to 2015, Amazon paid only 13 percent of its profits in taxes, Apple paid 17 percent, Google paid 16 percent, and Facebook paid just 4 percent. On the contrary, the average tax rate for the S&P 500 was 27 percent.

Oh, wait. Remember Amazon’s contest for their second headquarters? State and city officials bent over backward for Amazon’s HQ2. In fact, the city of Chicago proposed to transfer its tax authority to Amazon and have Amazon allocate taxes in a way best for Chicagoans. Amazon allocating taxes in a way best for Chicagoans? Give me a break. They barely pay any corporate taxes now with the government’s authority.

Here’s where antitrust laws can come into play.

Beginning with Google, it dominates a 92 percent share of the Internet search market. Imagine if a car company or an airline owned 92 percent share of their market? Search alone drives traffic to many websites and grants many businesses the opportunity to thrive, so I wonder what will happen to one of Google’s competitors if they sell a similar product as Google does and gets on their bad side?

Next, Amazon has been able to keep small businesses small through their Amazon Web Services and Marketplace platforms. When a company begins to gain traction on Amazon’s platforms, Amazon will recreate that company at the fraction of the cost, like Amazon Basics. Or ask Amazon Alexa to buy Duracell brand batteries (or any other branded batteries), and you’ll soon realize the only batteries you are able to purchase are the Amazon Basics brand.

Let’s not forget Facebook. The percentage of time spent on our phone while using apps is 85 percent. Believe it or not, four of the top five most popular apps globally, Facebook, Instagram, WhatsApp and Messenger, are all owned by Facebook.

With regard to Apple, they sold their iPhone 8 Plus for $799, while the total cost of the product is $288. As many others can agree, Apple has very high prices, and has very loyal customers. Ever wonder why text messages are green and annoying? So that anyone using an Android will think twice about buying that phone again.

Breaking up big tech will increase the tax base, influence more innovation (Microsoft case in 2001) and create more jobs. In 2001, it was ruled that Microsoft was found guilty of holding a monopoly. The decision forced the company to break up into two separate entities (one to produce the operating system and the other to produce other software elements). Many believe that without this ruling tech giants of today would not be able to survive as Microsoft would have either acquired these companies or would have been crushed early on. But, how will big tech be broken up? If the breakup of big tech occurs, then each entity within each of the companies should be split into smaller companies. Take Facebook as an example: Facebook, WhatsApp, Instagram and possibly Messenger would be separated. The split of Facebook’s entities alone would create more competition within the digital advertising industry, create more jobs and inspire innovation.

Hopefully, you’ve realized that time’s up for big tech.

Ben Bishop • Apr 29, 2019 at 5:55 pm

Bravo!